Crypto Plunge | Cryptocurrency Prices dropped by USD 400B | Billionaires lose USD 60B

Fortunes rise and fall in the volatile world of cryptocurrency, but over the last few weeks, they’ve only moved in one direction — down — Crypto Plunge.

|

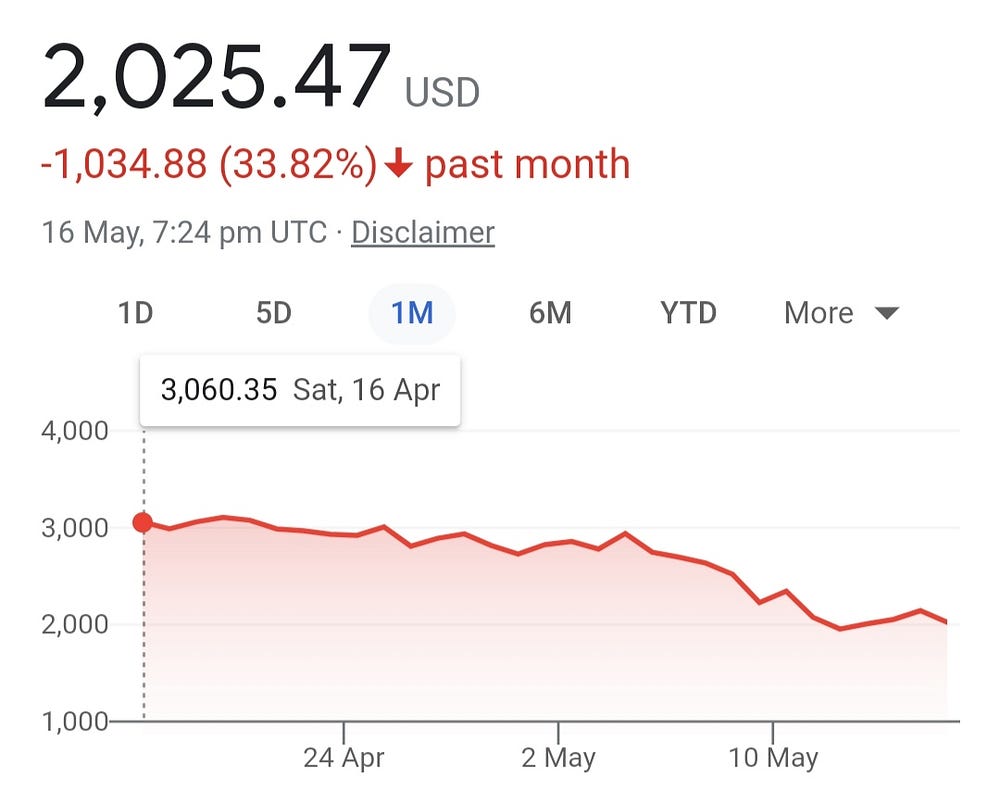

| Ethereum Price variation over one month |

The current price of Ethereum as of 16 May 2022 is USD 2,025 which is USD 1,034 less than it was a month back. That’s a whopping 33.82% price drop of Ethereum over a month.

|

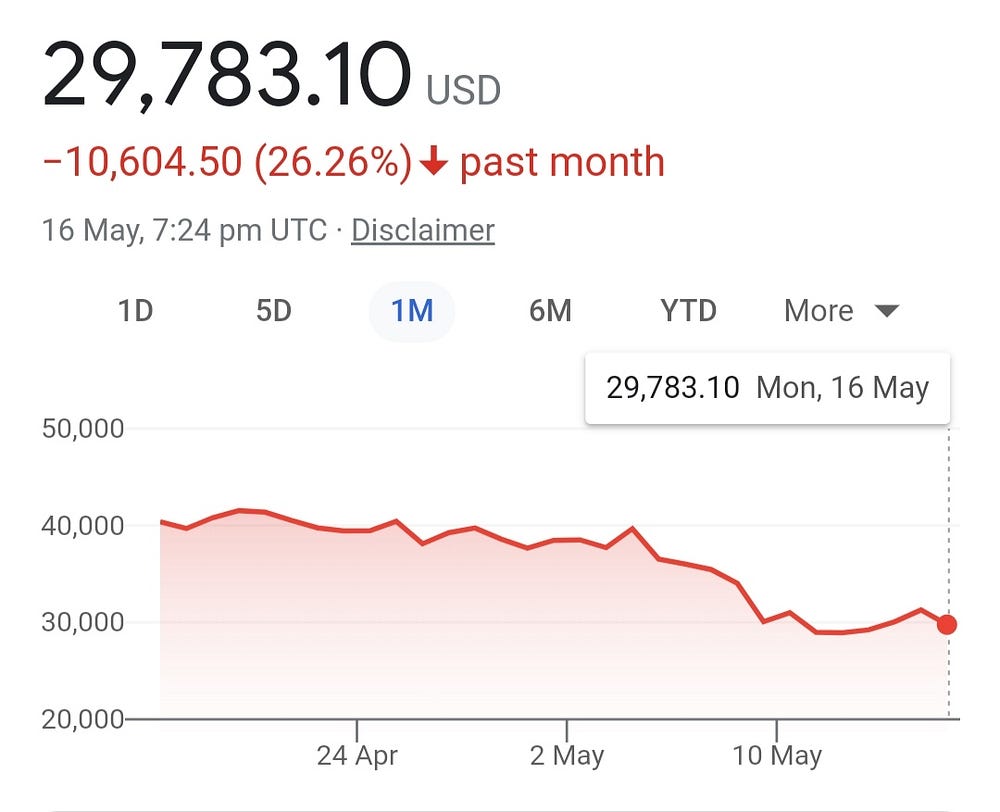

| Bitcoin Price variation over one month |

The current price of Bitcoin as of 16 May 2022 is USD 29,765.10 which is USD 10,604.50 less than it was a month back. That’s a whopping 26.26% price drop in Bitcoin over a month.

The total value of all outstanding cryptocurrency tokens is down over 26%. On March 11 Forbes counted 19 crypto billionaires. Now, just 16 are billionaires, Forbes estimates.

For moguls whose net worths are hitched to token prices and publicly traded stocks of crypto firms, it’s been a difficult few weeks. Eleven of the industry’s wealthiest individuals have collectively lost nearly $60 billion. This downfall resulted in a drop of USD 400 billion from the market value.

|

| Binance CEO Changpeng Zhao (CZ) |

One person accounted for the vast majority of that loss. Binance CEO Changpeng Zhao (CZ) was the industry’s wealthiest person in March with an eye-popping USD 65 billion fortune. Today, Forbes estimates he is worth USD 17.4 billion, based on the declining multiple of Coinbase, Binance’s publicly traded peer. Not that CZ is worried. The billionaire, who has previously brushed aside speculation on his net worth, tweeted Wednesday: “We need to respect the market, with a level of caution too. It goes up and down in cycles. And especially the fact that it doesn’t always make sense.”

1/8 These past weeks have proven to be a watershed moment for the crypto industry. We have witnessed the rapid decline of a major project, which sent ripples across the industry, but also a new found resiliency in the market that did not exist during the last market downswing.

— CZ 🔶 Binance (@cz_binance) May 15, 2022

|

| Brian Armstrong, CEO and Co-Founder CoinBase |

Brian Armstrong and Fred Ehrsam, founders of publicly traded crypto exchange Coinbase, both lost more than half of their fortunes. Armstrong, Coinbase’s CEO, is worth USD 2.8 billion, down from USD 6.6 billion on March 11. Ehrsam, who left the company in 2017, has fallen from the billionaire ranks; Forbes estimates his net worth at USD 986 million. Coinbase shares, which closed on Friday at USD 67.87, have fallen 57% since March 11, and 80% from their all-time high of USD 343 last November.

On Sunday, Ehrsam — in an apparent vote of confidence for crypto — tweeted a photo of The Big Short’s Michael Burry (played by Christian Bale), the legendary hedge fund investor who successfully shorted the housing market in 2008. On Tuesday, Armstrong denied that Coinbase was at risk of bankruptcy after a public filing spooked investors.

|

| Michael Saylor, a Bitcoin bull and CEO of software firm Microstrategy |

Michael Saylor, a Bitcoin bull and CEO of software firm Microstrategy, is no longer a billionaire. The market turbulence has been a double whammy for Saylor, hitting his personal stash of 17,732 bitcoins and his MicroStrategy stock, which has fallen 47% since March 11.

MicroStrategy shares are closely correlated with Bitcoin’s prices because the company has spent over USD 4.5 billion on the cryptocurrency, at an average purchase price of USD 30,700 per token. That investment is currently underwater, with Bitcoin trading at around USD 30,030 as of 4:00 pm eastern time. Like his peers, Saylor doesn’t seem worried. “The Best is yet to come,” he tweeted Friday morning.

Jed McCaleb and Chris Larsen, two co-founders of blockchain-based payments system Ripple, have lost USD 300 million and USD 1.1 billion, respectively. XRP (Ripple’s native token) has fallen nearly 50%. Venture capitalist Tim Draper, who bought around 30,000 bitcoins in 2014 from a U.S. government auction of the Silk Road’s confiscated bitcoins, has also departed the three-comma club.

The holdings of crypto tycoons whose fortunes are tied up in venture-backed companies have not yet been marked down — for now, at least. That’s why Sam Bankman-Fried, the shaggy-haired founder of crypto trading platform FTX, is still worth USD 21 billion, down only USD 3 billion since March. FTX raised USD 400 million in January at a USD 32 billion valuation, with institutional investors like the Ontario Teachers’ Pension Plan Board jumping on the crypto firm’s cap table. On Thursday, Bankman-Fried revealed he was taking advantage of the downturn and had built a 7.6% stake in Robinhood, a trading app popular with crypto investors and retail stock investors.

The same goes for Cameron and Tyler Winklevoss — Mark Zuckerberg’s college nemeses, turned Bitcoin billionaires. The twins’ Bitcoin holdings have slumped, but Gemini, the private crypto exchange they founded and run, is still valued at USD 7.1 billion, based on a fundraising round in November.

Unsurprisingly, there is little sympathy out there for crypto’s richest.

“Crypto billionaires are still crypto billionaires,” Scott Welker, a digital assets investor and podcaster, tells Forbes. “The larger concern is the small investors that were all in crypto, and have lost everything.”

No comments:

Post a Comment

Are we missing something? Do you need some more information? Comment it and we will surely add it! Keep smiling!